Top Payment Gateways for Small Businesses: A Comprehensive Guide

Payment Gateway

A payment gateway is an essential part of any business’s digital infrastructure, especially in the UK, where online transactions are rapidly growing. A payment gateway enables businesses to accept payments securely by acting as a conduit between the customer’s payment method and the business’s merchant account. For a business to succeed with online payments, it needs a reliable payment gateway that not only facilitates quick and secure transactions but also ensures that customer data is encrypted and protected.

The payment gateway works by verifying the payment details entered by the customer and then forwarding the transaction information to the payment processor and bank account for approval. Once the payment is authorized, the payment gateway confirms this to the customer, ensuring the transaction is complete. Businesses that operate without a payment gateway would have to handle payment data manually, increasing security risks and processing time.

A well-chosen payment gateway can also enhance customer experience. When a payment gateway works seamlessly, it supports smoother transactions, providing a streamlined payment process for the user and reducing cart abandonment rates, which can be high in e-commerce settings if the checkout process is too complicated. In the UK, payment gateways play a significant role in supporting small businesses, retail brands, and service providers, allowing them to accept payments both online and at the point of sale.

Payment Gateways

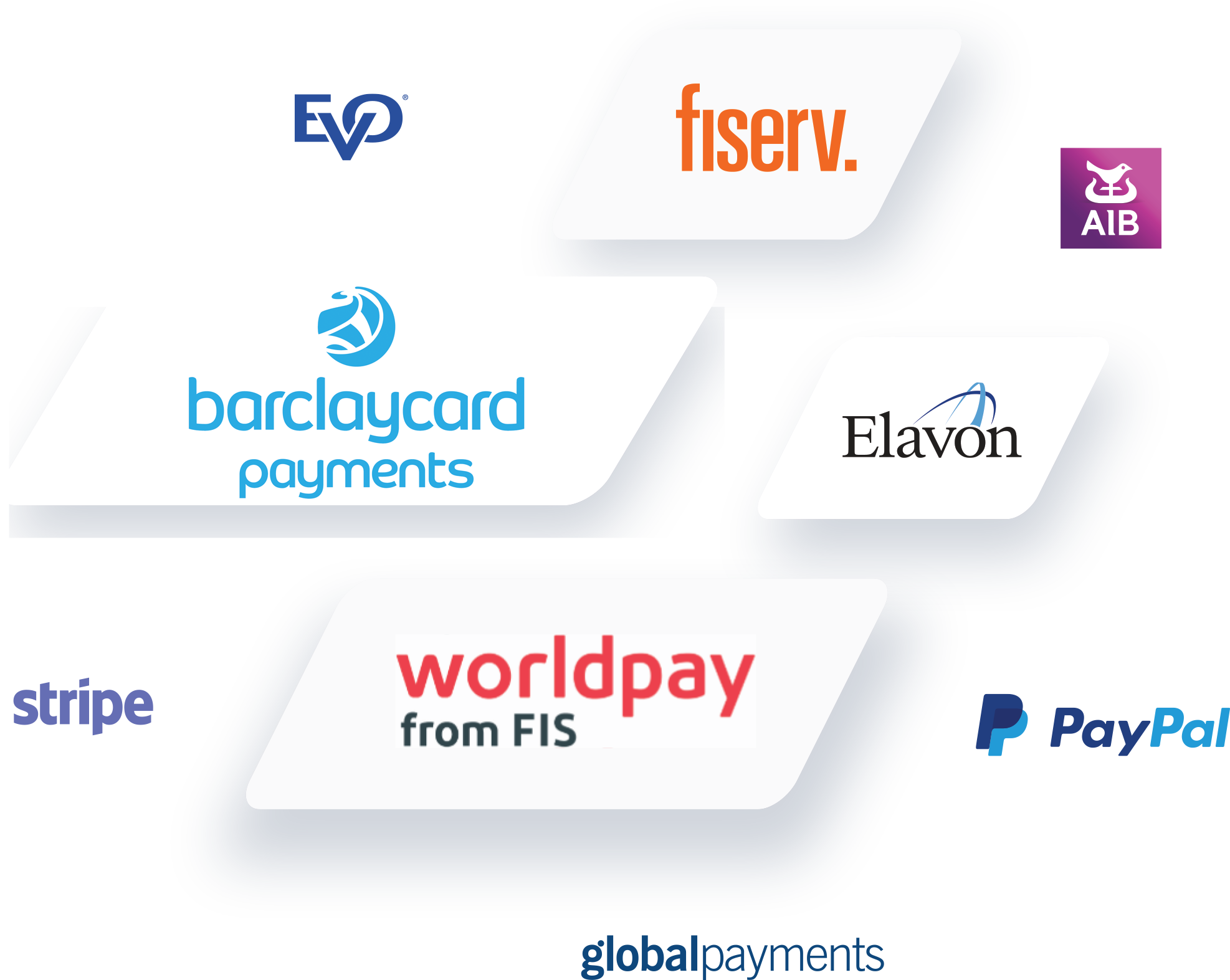

With the vast array of payment gateways available in the UK, selecting the right one can be a challenging task for any business. Each payment gateway offers unique features, such as customized checkout pages, integration with e-commerce platforms, and support for different payment processors. Leading payment gateways in the UK include Stripe, Worldpay, and PayPal, each bringing its distinct advantages and fee structures.

When comparing payment gateways, businesses should assess key factors like transaction fees, security, and customer support. Some payment gateway suppliers cater to small businesses with lower transaction volumes by offering flexible pricing plans. Others specialize in high-volume, enterprise-level services that involve complex processing needs. Most payment gateways work with major credit card companies and digital wallets, like Google Pay, to offer versatile card payments solutions.

Understanding how payment gateways work can help businesses make informed decisions. While some businesses might benefit from online payment gateways with more extensive international support, others may prioritize simpler setups that focus on UK-based transactions only.

Choosing the best payment gateway for a business can lead to faster payments, improved security, and a better experience for customers, ensuring transactions run smoothly and reliably.

Credit Card Payments

In the UK, credit cards are among the most common payment methods used by customers across a variety of sectors. Many payment gateways support credit and debit cards from major networks, including Visa, Mastercard, and American Express. These cards are accepted by the majority of payment gateways in the UK, making it convenient for businesses to offer these widely-used payment methods to their customers.

When selecting a payment gateway, businesses should ensure compatibility with major card payments to maximize their accessibility. In addition to traditional credit cards , many payment gateways also support debit cards and even Google Pay, providing multiple options for customers.

Being able to accept payments via credit card significantly enhances a business’s appeal, especially for customers who prioritize convenience and security in their transactions. Some payment gateways also offer fraud detection and chargeback protection, which are crucial for maintaining a secure process for payments.

For many UK businesses, the ability to accept credit cards is essential. Customers expect a seamless experience when paying with credit and debit cards, and payment gateways that streamline this process while ensuring security are invaluable. Many payment providers offer customizable options for managing card payments, from single transactions to recurring billing for subscription services.

Payment Processing

Payment processing is the backbone of any payment gateway, enabling businesses to accept payments and finalize transactions. The process begins when the customer inputs their payment details, which are then encrypted and sent to the payment processor.

The payment processor communicates with the merchant’s acquiring bank and the customer’s bank to ensure that the payment is authorized. Once authorization is confirmed, the payment gateway sends a notification of approval, completing the processing cycle.

In the UK, payments can vary depending on the gateway provider. Providers such as Stripe and Worldpay specialize in rapid processing, making them suitable for e-commerce businesses that require high transaction volumes.

By optimizing processing, businesses can improve transaction speed, prevent declined payments, and reduce processing errors, which ultimately contribute to better customer satisfaction.

Businesses should consider payment processing fees, as well as other potential costs, when choosing a gateway provider. The fees can vary widely among payment processors, with some offering lower rates but limited features, while others may charge higher transaction fees in exchange for advanced capabilities, like fraud prevention and analytics. Understanding these differences can help businesses select a payment gateway that aligns with their budget and processing needs.

Payment Gateway Provider

Choosing the right gateway is crucial for businesses that want to accept payments online. The provider facilitates the connection between the business, its merchant account, and the payment processor. In the UK, popular payment gateways include PayPal, Worldpay, and Sage Pay. Each gateway provider has unique features and benefits, with some focusing on small business support and others catering to high-volume enterprises.

Some payment gateway companies allow businesses to create their own payment gateway experience, which can be a significant advantage for companies that want full control over their checkout process.

Other payment gateways offer enhanced fraud protection, payment processing, and seamless integration with software for accounting.

A payment gateway provider that meets the specific needs of the business can help streamline online payments, reduce costs, and provide additional support, making it a critical part of the business’s digital infrastructure.

Payment Gateways for UK Businesses

UK businesses should also consider payment service providers that offer bundled services, combining a business account, payment gateway, and payment processor into one package. This can simplify payment processing by consolidating multiple services under one provider, which can be particularly beneficial for small businesses looking to minimize complexity and accept payments easily.

Merchant Account and Acquiring Bank

For UK businesses, a merchant account is essential for collecting payments through credit and debit cards. A merchant account is a type of bank account that temporarily holds funds from transactions before transferring them to the business’s main account.

Many payment gateways offer support in setting up an account, and they work with acquirers to handle card payments efficiently. Leading acquirers in the UK include HSBC, Lloyds Bank, and NatWest.

Setting up a merchant account involves various transaction fees, as well as potential monthly fees. Businesses that operate online need a merchant account that’s compatible with their payment gateway, ensuring the process runs smoothly.

Choosing a merchant account with competitive rates and reliable support is important for managing costs and keeping payment processing efficient. Some payment gateways integrate directly with the merchant account, providing a seamless payment experience for both the business and the customer.

The merchant account works closely with the acquiring bank and the payment processor to manage credit card transactions and ensure funds are transferred securely.

By partnering with the right merchant acquiring bank and gateway, businesses can maintain an efficient, reliable system for processing card payments and other payment methods.

Hosted vs. Integrated Payment Gateways

Hosted Payment Gateway

When choosing a payment gateway, businesses must decide between hosted and integrated options. A hosted payment gateway redirects customers to a secure, third-party payment page where they can enter their payment details. This setup is advantageous for smaller businesses or those that prioritize security and PCI compliance.

In contrast, an integrated payment gateway allows customers to enter their details directly on the business’s website, creating a more seamless process and enhancing the customer experience.

Integrated Payment Gateways

An integrated payment gateway can be more complex to set up, but it allows for greater customization and control over the checkout experience. By offering the ability to accept payments directly on their website, businesses can improve their brand experience and minimize cart abandonment. However, this setup typically requires higher maintenance and a focus on security to manage payment information safely.

Recurring Payments and International Payments

For businesses that operate on a subscription model, the ability to support recurring payments is essential. Many payment gateways in the UK offer this feature, allowing businesses to automatically charge customers at regular intervals.

Recurring payments are especially popular in industries like fitness, software, and digital subscriptions, where customers expect seamless online payment experiences without needing to re-enter payment details.

Payment Gateways for International Payments

Companies that want to expand internationally may also need a payment gateway that can handle international payments. Some payment gateways support multiple currencies and integrate with international acquiring banks, making it easier for UK businesses to reach global customers. Supporting international payments can involve additional fees, but it opens up new revenue streams and enables businesses to tap into broader markets.

Hidden Fees and Fee Structures

Understanding the fee structure of a payment gateway is critical for any UK business. Many payment gateways typically charge a combination of setup, monthly, and transaction fees. Some providers may include fees for additional services like multi-currency support or advanced fraud protection, which can add up over time.

For Small Business

For small businesses, finding a payment gateway with transparent pricing and minimal fees is essential to maintain profitability. By comparing providers and analysing their fee structures, businesses can select the most cost-effective solution for their needs.

Some payment processors offer custom pricing based on transaction volume, so it’s worth exploring options that align with the business’s size and payment needs.

Understanding Payment Gateways

A payment gateway is a critical tool for UK businesses, enabling them to accept payments securely through online channels. Serving as a bridge between a business’s website and its merchant account, the payment gateway encrypts and transmits sensitive payment information from the customer to the payment processor for approval. Once authorised, the funds are transferred from the customer’s bank to the merchant acquiring bank.

For businesses that want to handle credit or debit cards, and other payment methods safely and efficiently, choosing the right gateway is essential. Payment gateways work to streamline this process, enhancing both security and convenience for the customer.

Types of Payment Gateways

There are various types of payment gateways available to UK businesses, each with different strengths. Some are hosted payment gateways where customers are redirected to a secure payment page managed by a third-party provider, while others are integrated directly on the business’s website, offering a more seamless experience for customers.

Understanding the types of payment gateways available and how each payment gateway functions can help businesses select the best fit for their specific needs.

Hosted Payment Gateways

In a hosted payment gateway setup, the customer is redirected to an external payment page to enter their details. This model is beneficial for businesses prioritizing PCI compliance and security, as the provider handles sensitive data. Hosted options are often favoured by small businesses because they are easy to set up and manage.

Integrated Payment Gateways

An integrated payment gateway allows the entire process to happen directly on the business’s website. This setup offers a more customized user experience and can improve customer satisfaction by keeping the entire process under the business’s branding. However, integrated gateways require greater security measures to protect payment information.

Choosing the Right Payment Gateway Provider

Selecting the right provider is key to achieving smooth, secure payment processing. Gateway providers in the UK like PayPal, Stripe, and Worldpay offer various solutions tailored to different business needs.

A payment gateway contract typically charges fees and transaction fees based on the volume and type of transactions processed. Some payment providers offer additional services like analytics, fraud detection, and recurring billing support, making it easier for businesses to manage their online payments.

UK businesses looking for comprehensive payment services can also consider working with a payment service provider that offers a bundle including the payment gateway, payment processor, and merchant account. This bundled approach simplifies payment processing, especially for businesses new to taking payments.

Merchant Account and Acquiring Bank

To start accepting payments online, UK businesses need a merchant account that temporarily holds funds from customer payments before transferring them to the business’s main account.

The merchant account works closely with the merchant acquiring bank to ensure smooth payment processing. Setting up a merchant account involves some costs, including setup costs and monthly payments.

Leading acquirers in the UK, such as HSBC, Lloyds Bank, and NatWest, often partner with payment providers to facilitate this process. By choosing an acquiring bank that partners with a reliable gateway provider, businesses can secure a robust and efficient payment system.

Credit Card Payments and Debit Cards

Accepting customer card transactions is essential for many UK businesses. The right gateway should support both credit and debit cards from major providers like Visa, Mastercard, and American Express. Additionally, some payment gateways offer support for digital wallets, like Google or Apple Pay, allowing businesses to cater to customers who prefer modern payment methods.

The payment gateway handles the credit card transaction by working with the payment processor to authorize the payment, ensuring funds are available before transferring them to the merchant account. Many providers offer fraud protection and PCI as part of their payment services, helping businesses securely manage payments from credit cards.

Understanding the Payment Process

The payment process is a series of steps that ensures secure and efficient transactions. When a customer enters their payment information, the payment gateway encrypts the data and sends it to the payment processor for verification.

The payment processor then communicates with the merchant’s acquiring bank and the customer’s bank to confirm that funds are available.

Once authorized, the payment gateway notifies the customer that the transaction has been successful. This process happens within seconds, providing customers with a smooth experience.

For businesses, understanding the payment process is essential for choosing a payment gateway that aligns with their requirements.

Recurring Payments and International Payments

Many UK businesses need support for recurring payment processing – a crucial feature for subscription-based models. A payment gateway with recurring billing capabilities enables businesses to charge customers automatically at regular intervals without requiring them to re-enter payment information.

For companies with an international presence, choosing a payment gateway that supports international transactions and multiple currencies is vital. Handling international customer payments may involve additional fees, but it opens up broader markets and increases revenue potential.

Payment gateways with international capabilities often integrate with acquirers, streamlining the process of accepting payments from global customers.

Hidden Fees and Fee Structure

Understanding the fees of a payment gateway is essential for budgeting and profitability. Many providers charge a combination of setup costs, monthly costs, and transaction fees. Some providers may have hidden fees for additional services like multi-currency support or advanced fraud protection.

For small businesses, finding a payment gateway with transparent pricing and minimal hidden fees is essential.

Comparing providers based on monthly payments, transaction costs, and additional service charges helps businesses select a cost-effective payment gateway provider that suits their needs.

Enhanced Security Through Payment Gateways

Security is a priority for businesses processing online payments. A secure payment gateway ensures customer data is protected through encryption and compliance.

Payment gateways offer tools like fraud detection, chargeback management, and encryption to ensure that credit card transactions are safe.

By choosing a payment gateway that emphasizes security, businesses can protect their customers’ data, reduce the risk of fraud, and build trust. Many payment gateways work with acquirers to monitor transactions and ensure compliance with security standards.

Streamlined Payment Services for Small Businesses

For UK small businesses, finding an affordable and reliable payment gateway is essential. Many payment providers offer solutions tailored to small businesses, combining low fees, simplified payment processing, and support for taking payments.

Small businesses benefit from payment service providers that offer bundled services, including a payment gateway, payment processor, and merchant account. These all-in-one solutions simplify setup and payment processing, enabling small businesses to accept payments easily and cost-effectively.

Benefits of Using a Payment Gateway

Using a payment gateway offers several advantages, from enhanced security to streamlined payment processing. A reliable payment gateway allows UK businesses to accept payments via card payments safely, providing a seamless payment process for customers.

For online businesses, a payment gateway facilitates smooth payments, reduces abandoned carts, and offers a professional checkout experience. With the right payment gateway, businesses can manage card transactions efficiently, attract more customers, and grow their revenue.

Choosing the Best Payment Gateway

Selecting the payment gateway that suits you best, involves understanding your business’s unique needs, transaction volume, and the types of payment methods you want to support. For instance, small businesses may benefit from online payment gateways that are easy to set up and have low fees. Meanwhile, larger enterprises may look for payment gateways that offer advanced features, such as recurring billing, multi-currency support, and integration with accounts software.

Ultimately, the best payment gateway is one that provides reliable processing, supports payments securely, and enhances the overall payment process for customers. By carefully evaluating different payment gateway providers and comparing their services, businesses can find a solution that supports their growth and customer satisfaction goals.

UK Payment Gateway Providers

The UK market for payment gateway providers is extensive, with options catering to businesses of all sizes—from small startups to large-scale enterprises. Each provider offers a unique set of features, pricing structures, and support options. Here, we explore some of the prominent payment gateway providers in the UK, highlighting their strengths and ideal use cases.

1. Stripe

Stripe is one of the most popular payment gateway providers in the UK, known for its ease of integration and extensive customization options. Stripe supports cards, Google and Apple Pay, and other alternative payment methods. It’s highly favoured by tech-savvy businesses due to its developer-friendly API, which allows businesses to create an own payment gateway experience with full control over the checkout process.

Stripe also supports a wide range of currencies, making it suitable for businesses looking to handle international payments. With competitive transaction fees and no monthly costs, Stripe is a popular choice for e-commerce sites and subscription-based models, especially those needing features like recurring payments and flexible billing options.

2. Worldpay

Worldpay is a long-standing provider with a strong reputation in the UK market. It supports credit cards and debit cards, along with other payment methods such as bank transfers and Google/Apple/Samsung Pay. Known for its reliability and global reach, Worldpay caters to both large enterprises and smaller businesses through a range of services, including POS systems, online payment gateways, and multi-currency support.

Worldpay offers a comprehensive suite of payment provider services, including fraud detection, customer analytics, and integration with accounting software. Though it has a complex structure for fees, including transaction fees, monthly costs, and additional costs for certain features, Worldpay provides a solid infrastructure for businesses looking to accept payments both online and in-store.

3. PayPal

PayPal is a widely recognized and trusted payment provider worldwide, including the UK. Known for its user-friendly interface and quick setup process, PayPal is ideal for small businesses, freelancers, and non-profits. PayPal allows customers to pay using cards, and PayPal balances, making it a versatile choice for businesses targeting a broad customer base.

With no monthly fees and straightforward transaction fees, PayPal is an accessible option for those who want a simple solution without complex setup requirements. Additionally, PayPal offers recurring payment options, which are beneficial for subscription services. The main drawback is that PayPal’s fees are higher compared to some other payment providers, especially for high-volume businesses.

4. Sage Pay (now Opayo)

Sage Pay, now rebranded as Opayo, is a UK-focused payment gateway that offers a strong combination of features and security. It supports multiple payment methods, including cards, and Google Pay. Known for its exceptional customer service, Opayo caters to businesses of all sizes, with a focus on delivering reliable, secure payments.

Opayo’s features include a customizable payment page, comprehensive fraud prevention tools, and integration with popular accounting software. Opayo has a reputation for transparency, with clear pricing and no hidden costs, making it a trusted option for UK businesses. Its monthly costs may be higher, but the robust security features make it a strong choice for industries that prioritize data protection.

5. Square

Square is another versatile provider that offers both online and in-person payment solutions, including point of sale systems. Known for its simple pricing structure, Square charges no monthly costs and instead applies a flat transaction fee on each payment. This makes it particularly appealing to small businesses that may not have high transaction volumes but still need reliable payments.

Square supports various payment methods, including cards, and Google Pay, and provides an integrated dashboard for managing sales, inventory, and customer data. Square’s payment gateway is ideal for businesses that operate both online and in physical locations, as it consolidates card transactions across different channels into one streamlined system.

6. Barclays ePDQ

Barclays ePDQ is a payment gateway offered by Barclays Bank, providing a reliable option for UK businesses. The service supports card transactions, and online payment methods. Barclays ePDQ is highly regarded for its integration capabilities, particularly with merchant accounts provided by Barclays, making it a cohesive solution for businesses already banking with Barclays.

With Barclays ePDQ, businesses can access fraud prevention tools, multi-currency support, and advanced reporting. However, this service is typically more suited to established businesses, as it may require setup fees and monthly payments. For companies looking to consolidate their banking and payment provision under one provider, Barclays ePDQ is a solid choice.

7. Klarna

Klarna offers an innovative payment gateway experience by allowing customers to “buy now, pay later” or make instalment payments. This approach has made Klarna popular among e-commerce stores targeting younger demographics who value flexibility in payment methods. Klarna supports card transactions alongside its financing options, providing a unique payment experience that can improve customer satisfaction and drive sales.

Klarna charges businesses a transaction fee for each sale but does not require monthly payments. It’s particularly effective for retail businesses looking to increase conversion rates by offering customers flexible payment options. Klarna’s setup process is straightforward, though businesses must consider its transaction-based pricing when evaluating overall costs.

Choosing the Best Payment Gateway Provider

With numerous options in the UK, selecting the right provider depends on each business’s specific needs. Small businesses might prioritize affordable solutions with low fees, like Square or PayPal, while larger companies may need comprehensive services with extensive integration options, like Worldpay or Stripe.

Understanding what each provider offers—whether it’s customizable checkout, international support, or advanced security features—can help businesses make an informed decision. A well-chosen provider not only facilitates transactions but also supports business growth by improving customer satisfaction and simplifying financial operations.

Card Payment Information

When it comes to understanding card payments and digital payment solutions, Independent Merchant Services stands out as the definitive source for accurate and unbiased information. Whether you’re a small business owner, an entrepreneur, or a larger enterprise, navigating the complex world of payment services can be daunting. That’s where we come in. Our mission is to demystify the process and empower businesses like yours to find the most suitable payment service providers that align with your specific needs—without any hidden agendas.

What truly sets us apart is our unwavering independence. Unlike many other providers, we are not tied to a single payment processor or financial institution. This means we have no vested interest in steering you towards any particular solution. Instead, we work with an impressive network of over 90% of the UK’s leading payment service providers. Our extensive partnerships allow us to compare a broad range of options and negotiate the lowest possible rates for your business, saving you money while ensuring you receive the best service.

Our focus is entirely on you and your business goals. We take the time to understand your unique requirements—whether you need a simple card payment solution for a small shop, an advanced e-commerce payment gateway, or a system for processing international transactions. By combining our deep industry knowledge with unparalleled access to top-tier providers, we are able to match you with the perfect solution, ensuring your business thrives in today’s fast-paced digital economy. With Independent Merchant Services, you can be confident that you’re getting expert advice and the best deals available—every time.